SECTION 2: Trends, Innovations and Value

How do we ensure the future success of B2B incentive and loyalty programs?

IESP members are full-service incentive and loyalty solution providers who invest heavily in monitoring trends and innovations related to our field. For the purposes of this study, we wanted to hear from corporate buyers directly about what they are doing or seeing specific to their programs. The following section will explore the trends and innovations that they value most.

In the questionnaire, we kept our focus on more tangible strategies and tactics to have this output be as practical as possible. This is not to say that recent innovations in our understanding of behavioral science, neuroscience and psychology are not important. They are crucial to forming the best program design. However, for this study, we explored the more functional aspects of program design.

TRENDS: WHAT ARE THE TOP TRENDS IMPACTING PROGRAM STRATEGY?

For our survey, we curated and assembled a list of trends specific to B2B incentive and loyalty programs found in research and other publications within the last 12 months. We asked our respondents to select which trends were most applicable to their businesses and their programs.

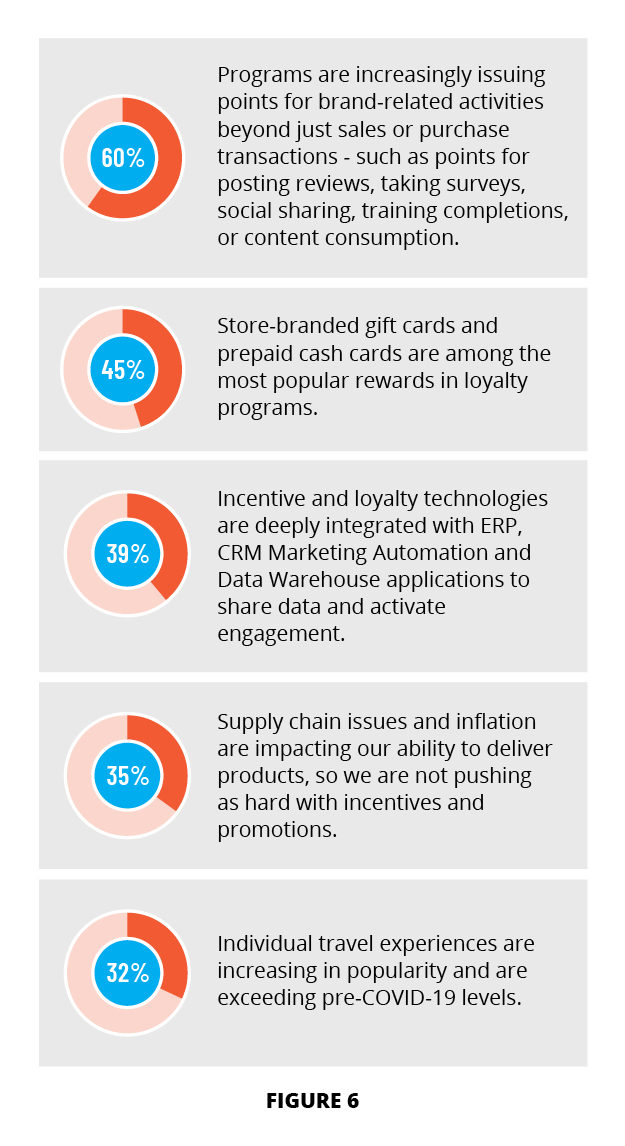

See figure 6 for the top trends in program strategy, according to survey respondents (ranked by percent of respondents).

Each of these trends stands alone and is self explanatory, but obviously not every trend applies to every program. It does seem clear, however, that many of the top trends identified have some connection to the global pandemic and the resulting economic environment. As we measure this over time, it will be interesting to see which trends stick around vs. those that are replaced by other priorities.

INNOVATIONS: WHAT PROGRAM CAPABILITIES WILL DRIVE THE FUTURE OF B2B INCENTIVE AND LOYALTY PROGRAMS?

Responses to this part of our survey truly indicate that the future of incentive and loyalty programs is bright when they are designed to be more dynamic and more fully integrated with the broader marketing tech stack.

In the past, programs were built and managed in isolation, with very limited ability to test, learn and evolve. A stand-alone platform technology housed a set rules structure mostly refreshed annually.

Program owners would launch the program with great enthusiasm and then wait at the finish line to see who won. That has changed dramatically in recent years, and full-service providers in this space are leading the charge.

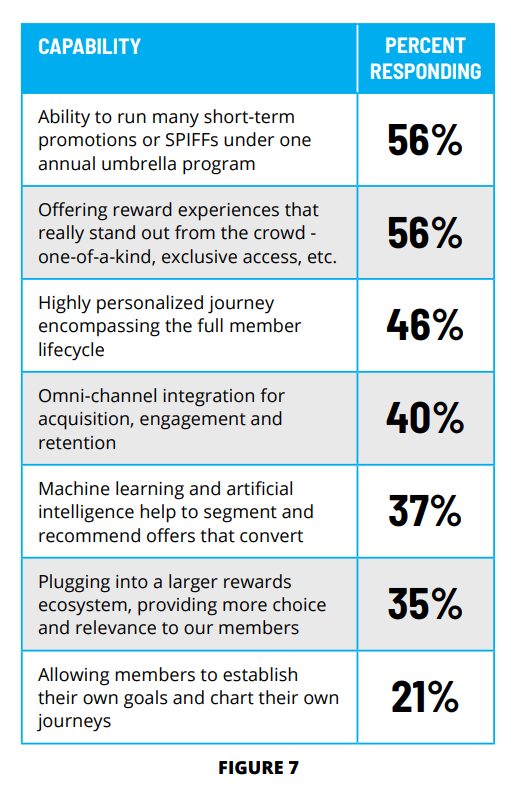

Staying relevant in this changing landscape is vital so we asked our survey respondents to select key emerging capabilities that will increase their ability to create engagement, increase efficiency and improve the effectiveness of their broader marketing efforts. Here is what they selected:

With the possible exception of the reward experiences, every other capability selected above (see figure 7) is enabled or made more efficient through modern technology. For example:

- The ability to spin up and communicate a double points promotion that sits on top of a core earning structure often needs to happen in a matter of days, not weeks or months.

- Highly personalized digital experiences require dynamic segmentation and the ability to communicate in a 1-to-1 manner. Triggers and known preferences are used to increase effectiveness.

- Those same dynamic segments must not live only in the incentive or loyalty platform but should feed your marketing automation and CRM tools.

- Data needs to be converted to intelligence, and with the volume of data being consumed, machine learning and artificial intelligence help with quality as well as speed.

- Online reward catalogs, especially in loyalty programs, are leveraging new exchanges where points can be shared or transferred. In some cases, they are even transferred for cryptocurrencies.

Program owners are embracing newer technologies and services to maximize their impact and maintain a competitive advantage. These innovations do not replace the core value of reward-based programs, and in fact, the rewards industry (travel, gift cards, merchandise, etc.) is doing a fantastic job of evolving with the preferences of our audiences. New capabilities that surround these highly sought-after rewards serve to increase engagement and impact. Our final section provides bonus content offering a glimpse of our respondents’ wish list for future innovations.

VALUE: HOW DO CORPORATE BUYERS PERCEIVE THE VALUE OF B2B INCENTIVE AND LOYALTY PROGRAMS?

B2B incentive and loyalty programs are among the most efficient marketing investments a company can make. Additionally, they have the potential to increase the power of all your other marketing investments. They collect original “zero party data” (intentional and proactive data shared by program members with a brand) and “first party data” (behavior and activity data in direct interactions with a brand), which make all other segment-based marketing efforts even smarter. In short, they provide an ROI-justified method of creating and growing stronger, sustainable relationships with a target audience.

But don’t take our word for it. We asked our survey respondents why incentive and/or loyalty-based rewards programs work for their companies. Some of the most salient responses are included to the right.

SECTION 3: Standards for Success

What are the minimum requirements for program design and infrastructure?

In this last section, we will share findings from some baseline questions we asked related to program design and infrastructure. These data points offer good references for program owners who are considering where and how to evolve their current programs. Many of these findings reinforce the trends and innovations we have already identified.

MINIMUM TECHNICAL CAPABILITIES